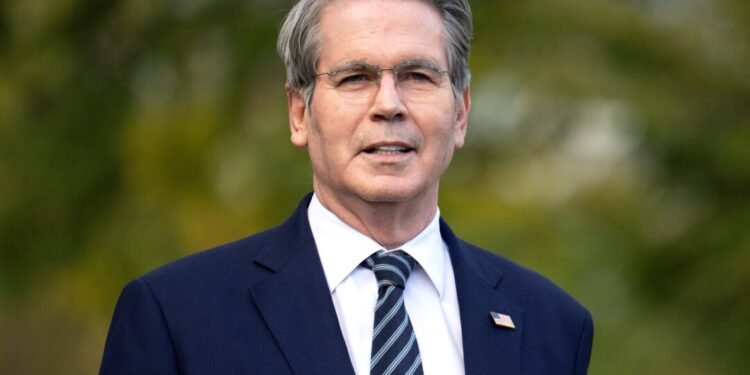

Treasury Secretary Scott Bessent has confirmed that the newly established “Trump Accounts” come with no restrictions on how families can utilize the funds, marking a significant development in the administration’s flagship child benefit program.

Speaking in a recent interview, Bessent outlined the flexibility built into the groundbreaking initiative, which will provide $1,000 deposits for children born between 2025 and 2028. The program, authorized through the Republican-backed One Big Beautiful Bill Act signed into law by President Donald Trump earlier this year, represents one of the administration’s most ambitious social investment policies.

Under the program’s framework, the federal government will make a one-time $1,000 deposit into designated accounts for eligible newborns. Beginning July 4, 2026, parents and guardians will gain the ability to make additional contributions to these accounts, creating a foundation for long-term financial growth.

The unrestricted nature of these accounts sets them apart from traditional education savings programs or retirement accounts that typically limit withdrawals to specific purposes. Families will have complete discretion over when and how to access the funds, providing unprecedented flexibility in addressing their children’s future needs.

President Trump has indicated that the program will benefit from additional private sector support, stating that other billionaires have committed to contributing to the initiative. “I’ll be doing it, too,” Trump added, suggesting personal financial backing for the program.

The timing of the July 4th launch date for parental contributions appears deliberately symbolic, aligning with Independence Day celebrations and the administration’s broader messaging about American prosperity and family values.

This development comes as the Trump administration continues to implement various provisions of the comprehensive One Big Beautiful Bill Act, which encompasses multiple policy initiatives across different sectors. The Trump Accounts program represents one of the most visible and immediately impactful components of this legislation.

The program’s structure suggests a departure from traditional government benefit programs that often include strict oversight and usage requirements. By removing these restrictions, the administration appears to be emphasizing parental choice and family autonomy in financial decision-making.

As the program prepares for its July launch, families across the nation are beginning to understand the potential impact of this unprecedented government investment in America’s youngest generation. The combination of initial federal funding and unrestricted usage creates new possibilities for how families approach long-term financial planning for their children.