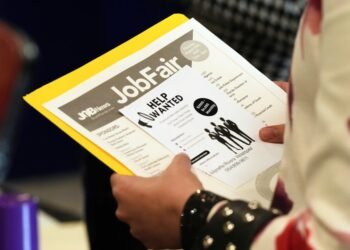

The American labor market is showing fresh signs of distress as private-sector job losses gained momentum over the past month, according to new employment data that could influence the Federal Reserve’s next monetary policy decision.

Fresh statistics from payroll processing giant ADP paint a sobering picture of the nation’s employment landscape. During the four-week period ending November 8, private companies shed an average of 13,500 jobs weekly, marking a troubling acceleration in workforce reductions across the economy.

This latest employment snapshot adds significant weight to growing expectations that the Federal Reserve will implement an interest rate cut when policymakers convene in December. The mounting job losses signal deepening weakness in what has been a resilient labor market throughout much of the post-pandemic recovery.

The ADP data, derived from the company’s weekly running estimate of employment trends, captures real-time shifts in hiring and firing patterns across thousands of private employers nationwide. Unlike monthly government reports that can lag behind rapidly changing conditions, these weekly figures provide an immediate pulse on labor market dynamics.

The accelerating pace of job losses represents a concerning shift from earlier periods when the private sector demonstrated remarkable staying power despite broader economic headwinds. The steady weekly decline of 13,500 positions suggests employers are increasingly cautious about maintaining current staffing levels amid uncertain economic conditions.

For Federal Reserve officials already grappling with mixed economic signals, the deteriorating employment picture could tip the scales toward more accommodative monetary policy. A softening labor market typically reduces inflationary pressures, potentially giving the central bank room to lower borrowing costs to stimulate economic activity.

The timing of these job losses comes as businesses navigate a complex landscape of challenges, including persistent inflation concerns, supply chain disruptions, and evolving consumer spending patterns. Many employers appear to be taking a defensive posture, prioritizing cost control over expansion as economic uncertainty lingers.

Market observers will be watching closely for additional labor market indicators in the coming weeks, as employment data remains a critical factor in Federal Reserve decision-making. The central bank has consistently emphasized the importance of maintaining full employment alongside price stability in its dual mandate.

As the December Federal Open Market Committee meeting approaches, these employment trends are likely to feature prominently in policymaker deliberations about the appropriate path forward for interest rates and broader economic support measures.